Demystifying Digital Tax Stamps

Digital Tax Stamps (DTS) have enhanced visibility into illicit trade, a previously opaque area, while simultaneously bringing more previously non-compliant taxpayers into the taxable fold.

The DTS solution was introduced by the Uganda Revenue Authority (URA) in 2019 as a solution to support the digitization of the tax system, ease tax administration, and curb tax evasion.

Keep Reading

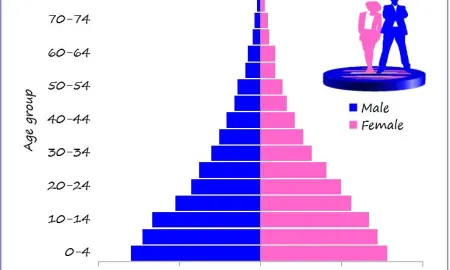

DTS has been pivotal in improving compliance, dramatically increasing the number of gazetted manufacturers and importers from 119 and 55 in six categories of local excise duty to 689 and 212, respectively, returning growth rates of more than 600% and 200%, respectively.

This significant rise underscores DTS's critical role in integrating previously unidentified taxpayers into the URA system. As of June 2023, the numbers expanded further to include over 1,120 manufacturers and over 330 importers.

Certain categories have shown exceptional compliance growth, with spirits surging by over 450%, while water and Kombucha experienced growth rates exceeding 230% and 500%, respectively, emphasizing DTS’s impact in boosting tax compliance across various sectors.

A recent report by PricewaterhouseCoopers (PwC) commissioned by the Private Sector Foundation Uganda (PSFU) on 9th May 2024 at an invite-only event at the Kampala Serena, used a different method of measuring impact than URA’s; the fiscal year 2018/19 as the baseline and had the effects of value-added tax analysis and Covid-19, overlooked by PSFU. Moreover, since its unveiling, the report has not been published online.

However, despite methodological differences, the positive results highlighted contrast with some conclusions drawn in the PSFU report, while the representativeness of PSFU’s sample data remained unverified.

According to the Ministry of Finance, the enforcement of the system had, by June 2023, significantly enhanced the declaration and payment of local excise duty, with revenue from spirits increasing by Shs36.44b, alongside substantial growth in production volumes across several product categories.

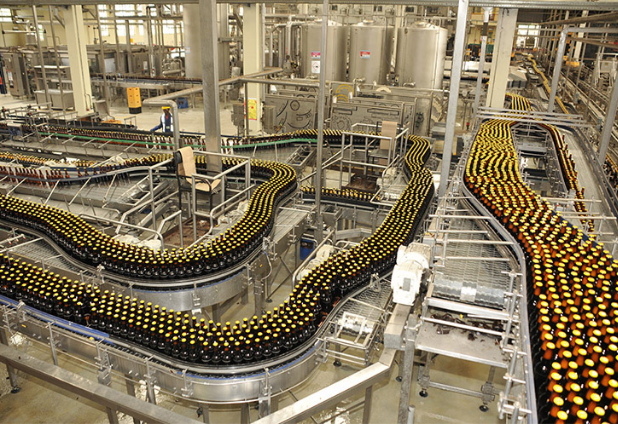

A report from the Ministry of Finance also indicates that beer production registered the highest growth in production volumes, rising by 81.30% to 516.4 million liters, while soft drinks, including soda and juice, rose by 25.64% to 918.2 million liters. Spirits volumes increased by 22.7% to 101.7 million liters.

However, there were declines in the production volumes of cement, sugar, and wines, while the report also indicated an increase in sales, leading to a 30% rise in tax revenues from digital tax stamps to Shs963.38b from Shs740.79b.

Despite critiques that DTS imposes heavy financial burdens, leading to operational inefficiencies and business closures, our findings present a different narrative. The system has fostered significant economic activities, evident from the expansion and technological upgrades undertaken by firms like Crown Beverages and Century Bottles. These expansions are not isolated; the entry of new businesses into the market underscores a vibrant economic environment.

On the alleged high costs of DTS associated with its implementation, the URA ensures that the integration of DTS marks, mostly direct prints, does not necessitate separate application modes for the vast majority of products.

This integration significantly reduces complexity and costs, as the necessary equipment installations and service are provided at no additional cost to the manufacturers. This alone debunks the myth of prohibitive costs burdening manufacturers.

Moreover, compliance with international standards such as ISO 22382 by DTS aligns the system with global best practices, ensuring its reliability and security.

Contrary to concerns about production delays attributed to DTS, manufacturers have stated that actual downtimes at factories have been minimal. Since the stabilization period shortly after DTS’s inception, downtime has been significantly reduced, approaching zero at many production sites. This efficiency has enabled continuous production flow with minimal interruptions.

As Uganda continues to navigate the challenges and opportunities presented by DTS, it is imperative for the Government of Uganda, through the URA and the Ministry of Finance, to engage stakeholders in informed dialogues based on empirical data. This approach will not only enhance understanding but also ensure the optimization of DTS benefits across the board.